Moving Average Forex Trading Strategy

This is the 2d article in our EMA series. If you oasis't already we advise that you check out the first article virtually the EMA Indicator. In that commodity, we covered the background of the "Exponential Moving Average", or "EMA", indicator, how information technology is calculated, and how information technology looks on a chart. The EMA was designed to shine out the effects of price volatility and create a clearer flick of changing cost trends. Traders employ an EMA, sometimes in concert with another EMA for a unlike catamenia, to signal confirmation of a change in price behavior.

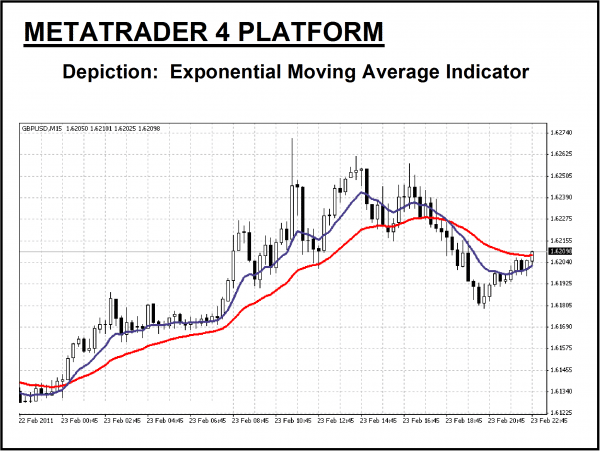

The benefit of the EMA indicator is its visual simplicity. Traders can quickly assess the prevailing trend of price behavior from the direction of the EMA. Intendance must be taken since the EMA is a lagging indicator and may not conform rapidly to volatility in the market. The EMA indicator will respond more rapidly than an SMA with similar settings since recent prices are given more weight.

How to Read an EMA Chart

The EMA works all-time when at that place is a potent trend present over a long period as in the above "GBP/USD" fifteen-Minute nautical chart. The EMA "Red" line follows the up tendency, lagging below and forming an angled support line until the trend begins to reverse its management. The "lagging" tendency of this indicator is emphasized in the latter portion of the chart when prices vicious very rapidly. The menstruum setting is "28" in the above chart. The "Blue" line EMA has a setting of "13" and reacts more than apace. False signals will prevail if an EMA is used in a ranging or sideways trending market, particularly one with a short setting.

The central points of reference are when the EMA crosses over the pricing candlesticks or another EMA. If prices are going upwards and a crossover occurs, that is viewed equally a "Buy" signal, and vice-versa.

As with any technical indicator, an EMA chart will never be 100% correct. False signals can occur, but the positive signals are consistent enough to requite a forex trader an "edge". Skill in interpreting and understanding EMA alerts must be adult over time, and complementing the EMA tool with another indicator is e'er recommended for further confirmation of potential trend changes.

In the adjacent article on the EMA indicator, we volition put all of this information together to illustrate a simple trading arrangement using EMA assay.

Adjacent Commodity >> Metatrader Exponential Moving Average Settings >>

Previous << Exponential Moving Boilerplate Crossover Indicator Explained <<

Various technical strategies based on crossovers explained.

Forextraders' Broker of the Month

ForexTime (FXTM) is an accolade-winning platform that certainly has the feeling of being set up by people who know what they are doing. The firm demonstrates an agreement of what helps traders brand ameliorate returns, and its success can be measured by the fact that it's doubled the number of clients information technology supports in recent years. The fact that the banker has grown to have more than two million accounts suggests it is getting things right for clients.

Source: https://www.forextraders.com/forex-education/forex-indicators/exponential-moving-average-strategy/

Posted by: smithshice1942.blogspot.com

0 Response to "Moving Average Forex Trading Strategy"

Post a Comment